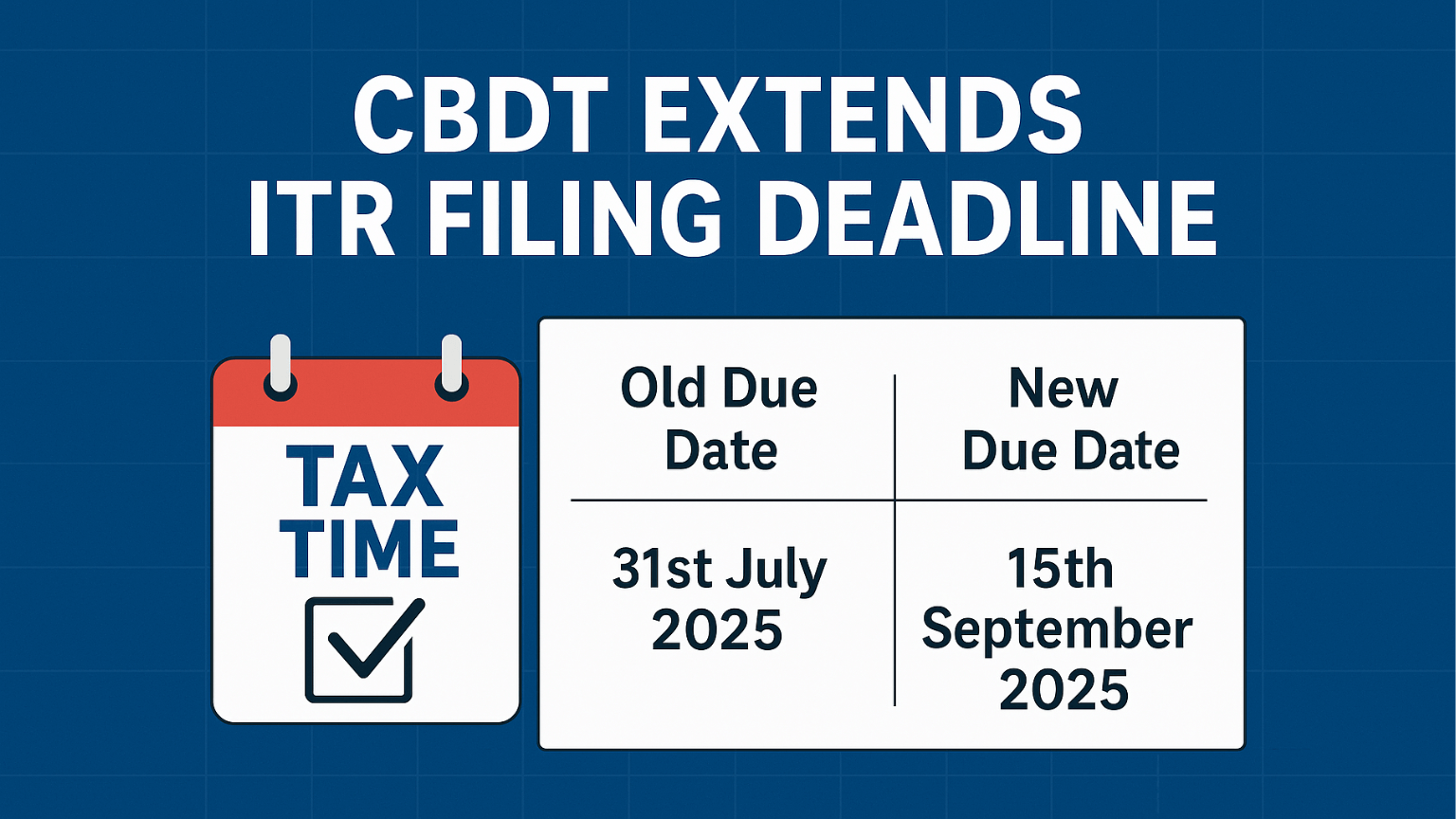

The Central Board of Direct Taxes (CBDT) under the Ministry of Finance, Government of India, has officially extended the due date for filing Income Tax Returns (ITRs) for the Assessment Year (AY) 2025-26, which were originally due by 31st July 2025. The new deadline is now 15th September 2025.

Key Highlights of the CBDT Press Release

1. Reason for Extension

The notified ITRs for AY 2025-26 have seen significant structural and content changes. These revisions aim to:

- Simplify tax compliance

- Improve transparency

- Enhance accuracy in reporting

However, these changes also require additional time for:

- System development

- Develop Utility

- Testing of updated filing tools

2. TDS Statement Challenges

Credits from TDS statements, which are due by 31st May 2025, will likely begin reflecting in early June. Without an extension, taxpayers would face a tighter deadline for filing, particularly when you factor in the time required to gather and verify all the necessary details.

3. Taxpayer Relief

The CBDT understands the hurdles people face and has taken steps to make the filing process easier by pushing back the deadline. This decision reflects the concerns voiced by various stakeholders and professionals.

4. Official Notification

A formal notification will be issued separately to solidify this extension in legal and procedural terms.

New ITR Filing Deadline for AY 2025-26

| Particulars | Old Due Date | New Extended Due Date |

|---|---|---|

| Filing of ITRs (AY 2025-26) | 31st July 2025 | 15th September 2025 |

Download Official Press Release From Here

Conclusion

The CBDT’s decision is a move aimed at improving the efficiency and accuracy of the income tax return process. It allows both individual taxpayers and businesses ample time to adjust to the new ITR formats, relieving them from the stress of the previous deadline.