Gold has long been one of the most trusted investment assets in India. Now you can buy gold gold cheaper than market price using credit cards —simply by using credit card hacks, coupon stacking, and platform-specific deals.

In this guide, we break down exactly how to save up to 20% or more when purchasing gold online. Whether you’re buying a small coin or investing in bridal jewellery, these strategies will help you buy smarter and save big.

Method 1: Buy Gold on Myntra Using Credit Card and Gift Card Hacks

You may associate Myntra mostly with fashion and accessories, but did you know they also sell gold coins? Even better, there’s a smart way to save big on your gold purchases on Myntra.

Step-by-Step Strategy:

Step 1: Buy a Myntra Gift Card via Maximize.Money

- Visit www.Maximize.Money.com and purchase a Myntra gift card.

- When you pay with a credit card, you get a 5.5% instant discount.

- For example, buying a ₹10,000 Myntra gift card will cost you only ₹9,450.

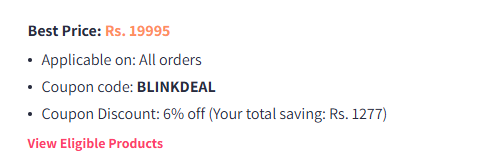

Step 2: Use Myntra Coupon Codes

- During checkout, apply any active gold jewellery coupons on Myntra. These can offer up to 6% discount.

- Keep an eye on special promotions like Myntra Gold Rush or Festive Gold Sale.

Step 3: Pay with a High-Reward Credit Card

- Use a premium rewards card like Axis Atlas, which offers up to 10% back in EDGE miles(when combined with Accor).

- These reward points can be redeemed later for flights, vouchers, or cashback, effectively increasing your savings.

Your Total Savings:

- 5.5% (Gift Card Discount)

- 6% (Myntra Coupon)

- 10.5% (Card Rewards)

Total Effective Discount: Up to 20%

That’s nearly one-fifth off your gold purchase without compromising on quality!

Method 2: Buy Gold from Tanishq with Tata Neu Credit Card

Tanishq, known for its premium gold and wedding jewellery, provides some excellent opportunities for price-savvy buyers—especially when combined with Tata Neu and internal discount schemes.

Step-by-Step Strategy:

Step 1: Use Tata Neu Infinity Credit Card

- Earn 5% NeuCoins (5% cashback) on gold purchases made through the Tata Neu app or at Tanishq outlets.

- NeuCoins can be redeemed later for discounts on future Tata brand purchases, including Tanishq.

Step 2: Combine with Tanishq Schemes

- Tanishq regularly runs in-house offers like the Rivaah Golden Advantage.

- This scheme can offer up to 50% off on making charges, especially during wedding season.

Practical Example:

Let’s say you’re buying a ₹1,00,000 bridal necklace:

- 5% cashback via Tata Neu = ₹5,000

- 50% off on ₹10,000 making charges = ₹5,000 saved

- Total savings = ₹10,000

Key Benefits:

- Trusted quality and BIS Hallmark gold

- Offline + online purchase flexibility

- Stackable discounts = big savings

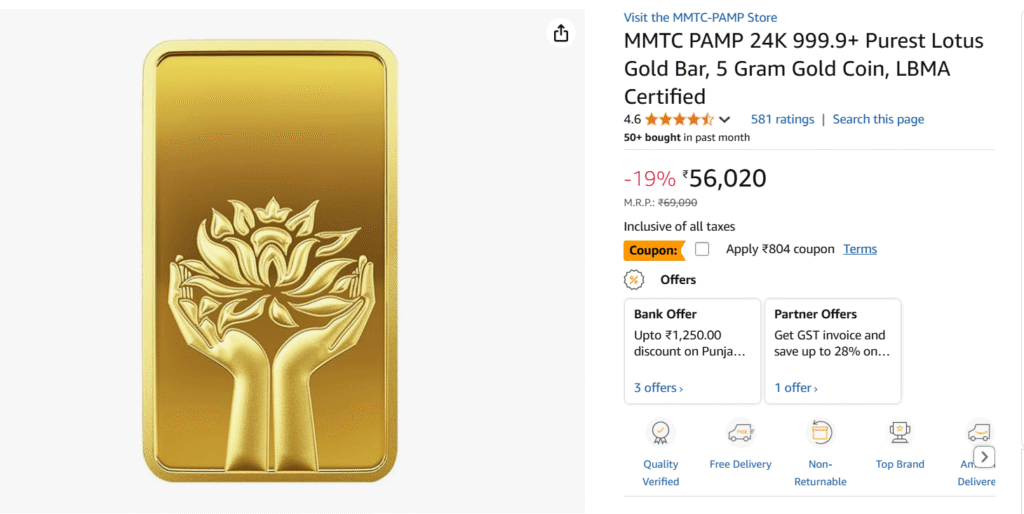

Method 3: Buy Gold on Amazon with Credit Card Offers

Amazon India has expanded its marketplace to include certified gold coins and bars, especially from reputed brands like MMTC-PAMP, Kundan, and Senco. The best part? You can stack bank offers and earn credit card points to get a great deal.

How It Works:

Step 1: Look for Bank Offers

- Amazon frequently features festive promotions and bank-specific discounts (SBI, ICICI, HDFC, Axis, etc.).

- Discounts typically range from 5–10%, especially during the Great Indian Festival and Prime Day.

Step 2: Use Credit Cards with Reward Programs

- Cards like Amazon Pay ICICI, HDFC Millennia, or Axis Neo offer 1–5% cashback or points on purchases.

- Some cards offer extra reward points on Amazon, which can be redeemed for gift cards or discounts.

Step 3: Use Amazon Pay Balance or EMI

- Combine offers using Amazon Pay Gift Cards or go for No-Cost EMI on gold jewellery.

Expert Tips to Maximize Your Gold Purchase Savings

1. Use High-Reward Credit Cards

- Choose cards that offer accelerated rewards on shopping, lifestyle, or specific platforms.

- Best examples: Axis Atlas, HDFC Infinia, ICICI Amazon Pay, Tata Neu Infinity Card

2. Compare Platform Prices

- Before buying, compare gold rates on Myntra, Amazon, Tanishq, CaratLane, and even Paytm Mall.

- Prices can vary based on making charges, purity, and brand.

3. Always Check for BIS Hallmark

- Only buy BIS 916 or 999 hallmarked gold to ensure authenticity and purity.

- It helps in future resale or pledge scenarios.

4. Combine Offers Whenever Possible

- Most platforms allow gift card + coupon + credit card rewards stacking.

- Use it smartly to unlock layered discounts.

Summary Table: How Much Can You Really Save?

| Platform | Method | Potential Discount |

|---|---|---|

| Myntra | Gift card + coupon + Axis Atlas rewards | Up to 20% |

| Tanishq | Tata Neu card + Rivaah scheme | Up to 15–20% (depending on making charges) |

| Amazon | Bank card discount + reward points | Up to 8–12% |

Final Words: Be a Smarter Gold Buyer in 2025

In today’s digital economy, gold buyers have more tools than ever to make smart, discounted purchases. Whether you’re buying a coin as an investment or bridal jewellery for a wedding, you don’t need to settle for market rates.

By combining platform discounts, bank offers, and credit card reward programs, you can cut your costs dramatically—sometimes by nearly 20%.

Start stacking those deals, use the right cards, and enjoy the twin benefits of wealth protection and savings.

Pro Tip: Bookmark this guide and revisit before buying gold during festive seasons like Akshaya Tritiya, Dhanteras, or Diwali for even bigger deals!